FORM GST DRC-05

[See Rule 142(3)]

To,

M/s TAXPAYER PARTY GSTIN: Tax Payer GSTIN Number

Taxpayer Party Business Register Address

Period : 01/07/2017 To 31/03/2018 (2017-18)

No: MUM-VAT-D-NO./ 2017-18 DRC-5/2023-24/B-432 Mumbai, Date- 28/11/2023.

SUB : To Conclude the Proceedings initiated in your case. Reference:

- Scrutiny notice in Form ASMT-10 vide reference No __________________________ Dated 04/07/2023

- Compliance made by taxpayer i.e. reply to notice issued under section 61 intimating discrepancies in the return in form GST ASMT 11 dated 13/07/2022.

- Intimation of tax ascertained as being payable under section 73(5) /74 (5) r/w Rule 142 in form DRC (01A) issued by this office vide Reference No. __________________________dated 08/08/2022

- Summary of SCN in DRC 1 issued reference no _________________________on Date- 21/09/2022.

- Compliance made by taxpayer in DRC-06 dated 17/10/2022.

Intimation of conclusion of proceedings

- Brief facts of the case: Intimation in FORM ASMT-10, Intimation in DRC 01 A, SCN in DRC 1 is issued for following scrutiny parameter/s;

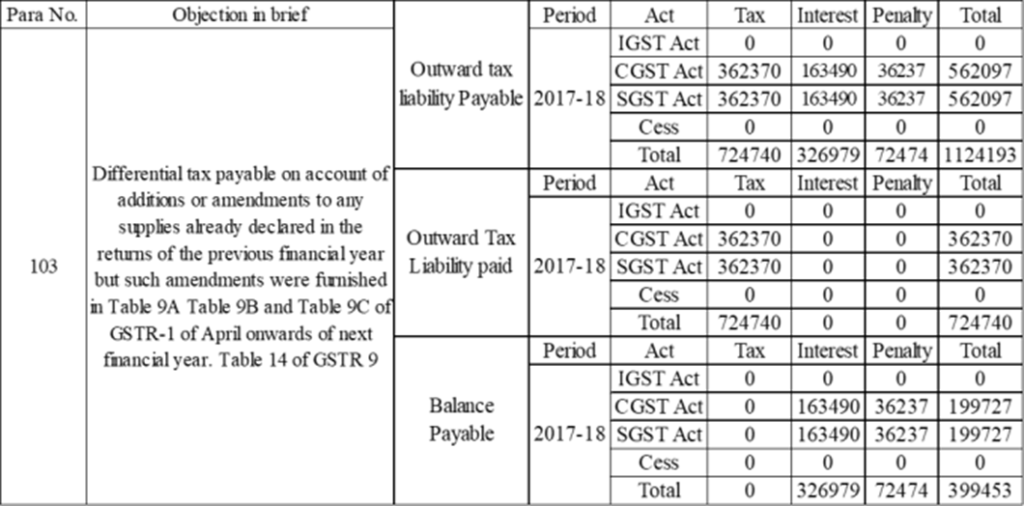

- Differential tax payable on account of additions or amendments to any supplies already declared in the returns of the previous financial year but such amendments were furnished in Table 9A Table 9B and Table 9C of GSTR-1 of April onwards of next financial year. Table 14 of GSTR 9.

- Grounds:

M/s. TAXPAYER PARTY holding GSTIN: Tax Payer GSTIN Number has filed GST returns for the period 01/07/2017 to 31/03/2018 in Form GSTR-3B, GSTR-1, GSTR 9. During the scrutiny of returns discrepancies are noticed. Accordingly, notice in Form ASMT-10 under section 61(1) of the MGST Act, 2017 was issued on 04/07/2023 and the taxpayer was asked to furnish reply within 30 days after receipt of the notice. Accordingly, the taxpayer replied on online portal in Form ASMT-11 dated 13/07/2022 along with Reply letter, Working sheet & voluntary payment details. While going through the submission and reply made by taxpayer it is noticed that the taxpayer has not produced proper supporting documents/reply/ explanation to his say & not paid interest as per Rule 88B of GST rules. Hence, the case is recommended for adjudication under section 73 of MGST Act, 2017.

Intimation in FORM GST DRC 01A as referred at Ref. No.3 was also issued. But the taxpayer neither submitted his reply in form GST DRC 01A –Part B on the GST portal, nor attended this office in response to the Intimation in FORM GST DRC 01A issued. Hence the show cause notice in FORM GST DRC– 01 is being issued as per reference no.4.

Accordingly, the taxpayer has filed reply in Form DRC-06 on 17/10/2022 along with reply letter & copy of DRC 03 dated 17/10/2022. In reply letter, a taxpayer has stated that, “Amendment of one party namely Buyer Party having GST No. Buyer Party GSTIN Number was done 2018-2019 having amended bill number LRA-4, LRA-4A, LRA-4B and original bill was RA-4, LRa-5, LRA-

6. We had paid all taxes correspondingly in the month of amendment and payment of interest via DRC – 03 dated 17/10/2022”

Hence, Reply filed by the taxpayer found satisfactory.

Para 103 Parameter

| Para No. | Description of Parameter | Total |

| 103 | Differential tax payable on account of additions or amendments to any supplies already declared in the returns of the previous financial year but such amendments were furnished in Table 9A Table 9B and Table 9C of GSTR-1 of April onwards of next financial year. Table 14 of GSTR 9 | 724740 |

| TOTAL | 724740 | |

Details of Discrepancies found:

Whereas the Taxpayer filed reply in DRC-06 which is verified. A taxpayer has paid outward tax liability of 2017-18 in 2018-19. Taxpayer in his reply stated that the amendment of one party namely the Buyer Party having GST No. Buyer Party GSTIN Number was done 2018-2019 having amended bill number LRA-4, LRA-4A, LRA-4B, and original bill was RA-4, LRa-5, LRA-6. After verification of these invoices, it is found that outward tax liability of amended invoices LRA-4, LRA-4A, LRA-4B already paid with original invoices, RA-4, LRa-5, LRA-6 in corresponding GSTR 3B of April-18, May-2018 & August-2018 respectively. Hence Total Interest liability payable is at Rs.156964/- & Rs.156964/- under the CGST act & SGST act respectively. As well as tax payer has already paid an interest amount of Rs.4466/- & Rs.4466/- under CGST act & SGST act respectively through DRC 03 dated 13/12/2019. Hence balance Interest liability payable is at Rs.152498/- & Rs.152498/- under CGST act & SGST act respectively.

Tax payer has paid balance interest amount on tax liability of 2017-18 paid in 2018-19 as per Rule 88B of GST rules by filling DRC 03 on date 17/10/2022.

As taxpayer has paid tax liability along with interest as above, hence the proceedings initiated vide the said notice are hereby concluded.